GBP/USD -

follow me on twitter @fxdailyforecast and stocktwits.com/fxg

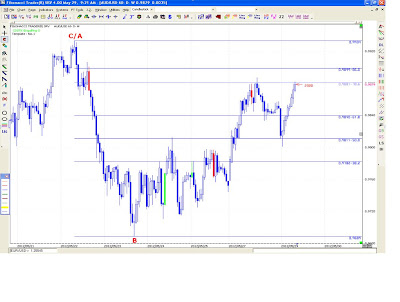

No trade setup yesterday, price fell and seems to have

given us a new B low down at 5461.

FOR TODAY:

We have a new AB swing in play. We can sell up at the

618/786 of this swing, after bearish cs formations.

No long trade since we don’t have the setups in place as

yet.

If we don’t get the setup we are looking for then we

don’t trade.

SHORT: Will be

going short only IF:

We need price to retrace to the 618/786 – very far off - of this swing followed by bearish cs

formations for a short entry. Place stop 13 pips above the cs high. Limits

defined at time of entry.

If we don’t get the set-up we are looking for then we

don’t trade.

LONG: Will be

going long today only IF:

No long trade setups since we don’t have an established B

swing low in place – so stand aside on

long entries.

If we don’t get the setup we are looking for then we

don’t trade.