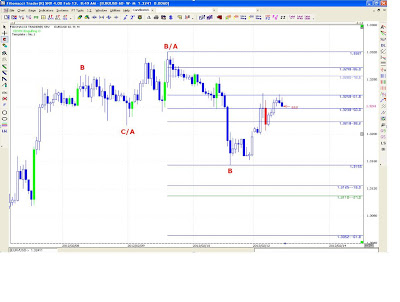

EUR/USD

The A low support was broken on Friday and price gave us a B for the new AB down swing. The reversal process has begun on this time frame.

FOR TODAY:

We are at the 618 of the AB swing; a bearish cs formation from current levels will initiate a short trade setup.

Violation of the 3321 highs will signal resumption of uptrend on this timeframe. To remain bearish we need to remain below 3321.

SHORT: WILL ONLY BE GOING SHORT IF:

We are in short territory, if we get a clear bearish cs foirmation we will entetr a short trade setup, stop 14 pips above the high of the cs formation, max 1.5% risk, limits will be 60-70 pips. If price rallies to the 786 and then gives us a bearish cs formation, trade this limit to the BF786, stop 14 pips above the cs formation.

If we don’t get the cs formations we are looking for then we don’t trade.

LONG: WILL ONLY BE GOING LONG TODAY IF

We can only go long if price reaches the BF786 followed by a bullish cs formation. Limits for this long entry will be at 3276. Stop will be 10 pips below the low of the cs formation, max 1.5% risk.

If we don’t get the setup we are looking for then we don’t trade.

No comments:

Post a Comment